The move by Gary Plessl and Kevin Houser from Ameriprise Financials’ 1099 platform to Wells Fargo FiNet underscores a growing reality for scaled advisory teams: semi-independence no longer delivers the economic or strategic advantages it once did.

Team Overview

Plessl and Houser collectively built a substantial advisory business generating approximately $3.9 million in annual GDC and overseeing roughly $600 million in client assets. Their practice serves affluent and high-net-worth households that require flexibility across advisory programs, lending, alternatives and long-term planning—capabilities that increasingly expose the limitations of captive or franchise-style platforms.

“This team’s decision was not driven by dissatisfaction with performance or clients. It was structural and economic,” said Roger Gershman, who is CEO of The Gershman Group, which represented this team as well as other Ameriprise teams.

Why They Left Ameriprise’s 1099 Platform

Any evaluation of Ameriprise’s 1099 channel must be viewed in the context of the firm’s broader business model. While Ameriprise supports roughly 10,000 advisors, its W-2 channel remains meaningfully more profitable than its independent franchise channel. The 1099 platform—despite representing a majority of advisors—operates on thinner margins that rely heavily on scale.

At the same time, Ameriprise is navigating several converging pressures:

- A large cohort of senior advisors retiring or exiting to full independence

- A shrinking pipeline of traditional W-2 recruits

- A sustained rise in regulatory, compliance, technology, and supervisory costs

These pressures are not unique to Ameriprise. However, the firm’s response has had outsized consequences for 1099 advisors.

The Global Administrative Fee (GAF) and Margin Compression

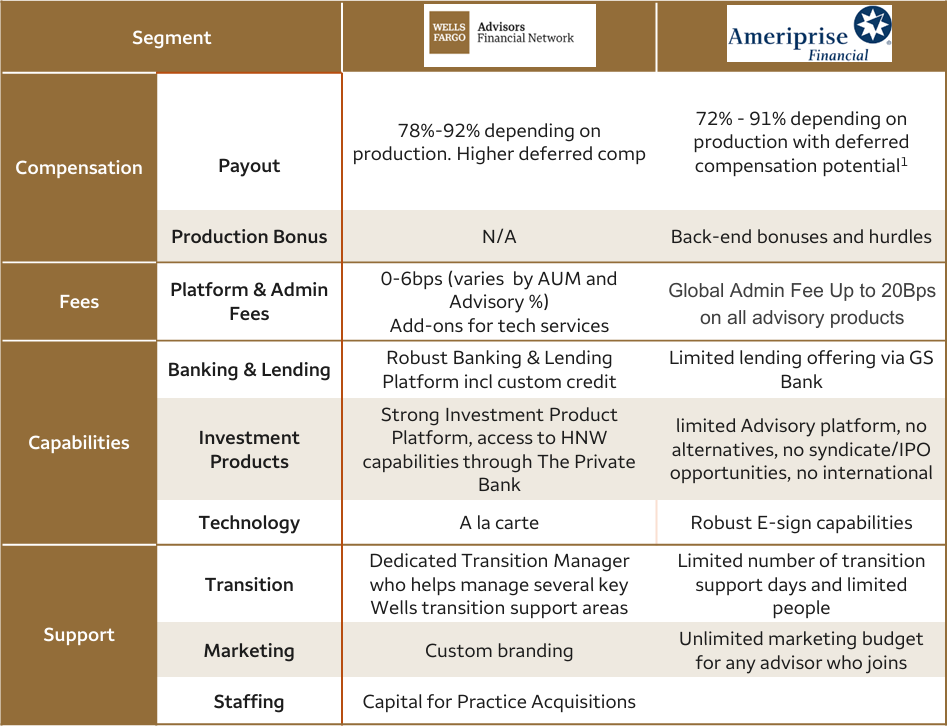

Ameriprise has increasingly passed platform costs through to advisors and their clients via the Global Administrative Fee (GAF)—an uncapped fee applied at the household level before advisor payout. As illustrated in the FiNet vs. Ameriprise comparison, GAF can reach over 20 basis points on advisory assets, materially reducing effective take-home compensation.

Because GAF is deducted before payout, the headline grid significantly overstates true economics. In practical terms, this compresses margins for 1099 advisors and narrows the economic gap between semi-independence and full independence.

Enterprise Value Friction and Reduced Portability

In parallel, Ameriprise has implemented policies that increasingly tie client relationships and enterprise value to the firm rather than the advisor. These include:

- Greater reliance on proprietary platforms

- Retirement and succession structures that complicate clean exits

- Legal frameworks that limit post-departure solicitation

The firm’s recent lawsuits against LPL and departing advisors highlighted a more defensive posture, particularly around restricting traditional Protocol protections for advisors operating in the 1099 channel.

Signature Wealth and Asset Stickiness

More subtly, the launch of Signature Wealth earlier this year introduced additional layers of friction. These accounts not only carry higher client fees, but also include provisions that make assets more difficult to transition away from the firm, further constraining advisor mobility and long-term optionality.

Compliance Built for the Lowest Common Denominator

Ameriprise’s compliance architecture is designed to manage risk across a large and heterogeneous advisor population. For sophisticated teams, this often results in:

- Branding and marketing constraints

- Product and allocation limitations

- Lengthy approval cycles

- Legal conservatism

- Reduced flexibility around alternatives and private investments

For businesses operating at Plessl and Houser’s scale, these constraints increasingly conflict with client needs and growth objectives.

Why Wells Fargo FiNet

For Plessl and Houser, Gershman explained, “FiNet offered a cleaner economic model with true ownership, while retaining access to a global financial institution.”

Unlike Ameriprise, Wells Fargo operates primarily as a 1099-based advisor ecosystem, with approximately 12,000 advisors across its platforms. Importantly, FiNet remains a smaller—but rapidly growing—division within that ecosystem, and executives have invested heavily in the past five years to align the company more directly with independent advisors.

Independence with Institutional Scale

Under FiNet:

- Advisors 100% own their firms, clients, and brand

- Custody is provided through Wells Fargo First Clearing, one of the five largest custodians in the U.S.

- Advisors retain full access to Wells Fargo’s institutional platform—without being employees

FiNet advisors have access to the same core capabilities available across Wells’ advisory channels, including:

- Advisory programs and SMAs

- Alternatives and structured products

- Sophisticated lending and credit solutions

- Trust and estate services

- Capital markets and investment banking access

- A full modern technology and client-delivery stack

The difference is not capability—it is ownership and control.

Lower Platform Costs, Higher Net Economics

As detailed in the FiNet vs. Ameriprise analysis, FiNet’s platform fees are materially lower and transparent, typically blending to under 4 basis points on advisory assets—versus Ameriprise’s uncapped GAF structure

In side-by-side examples (see attached), advisors moving from Ameriprise’s franchisee model to FiNet can see double-digit improvements in net effective payout, often exceeding 10 percentage points, even before considering enterprise value implications.

Competitive Transition and Long-Term Optionality

For advisors joining FiNet directly, Wells offers:

- Large upfront with no production hurdles

- Large backends compensation

- A retirement put option of ~250% at long-term capital gains

- Access to minority-equity capital via partners such as Merchant Investment Management (Read: Why Billion-Dollar Teams Are Moving to Wells)

- Firm-provided capital to acquire additional practices without personal balance-sheet risk

Some teams also choose to enter Wells’ Private Client Group before later transitioning to FiNet—capturing both a traditional wirehouse transition package and the long-term benefits of full 1099 ownership.

The Bigger Picture

Plessl and Houser’s move reflects a broader industry shift. Semi-independent franchise models once represented progress. Today, many advisors are concluding that true independence with institutional backing delivers better economics, cleaner ownership, and greater long-term enterprise value.

FiNet sits squarely at that intersection.

For teams operating at scale, the question is no longer why leave—but why remain structurally constrained.

As the Editor of The Gershman Group, a boutique financial services consulting firm, TGG brings expertise in financial analysis, strategic planning, and market research. With a keen eye for detail and a passion for helping businesses navigate complex financial landscapes, TGG delivers insightful, high-quality content to empower informed decisions. Backed by years of industry experience, TGG makes complex topics accessible through clear and compelling communication, shaping the firm’s thought leadership and commitment to excellence in financial services.