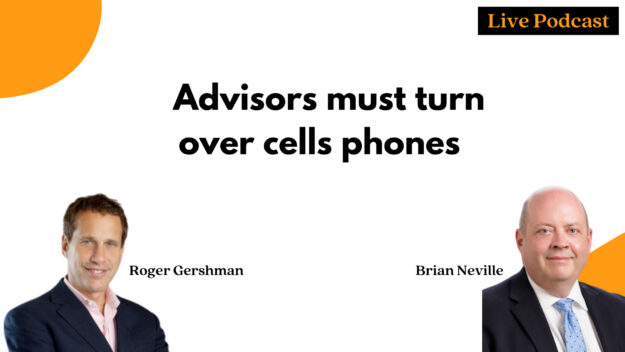

The Value Of Independence! Ask Roger – Podcast For Financial Advisors

Today’s podcast is about the value of independence. And why seriously consider going in the banks and brokerage firms have become a real thorn in advisor sides. They’re more interested in shareholder value, they’re more interested in compliance are more interested in legal, and they’re interested in the lowest common denominator of the financial…